Forex Candlestick Patterns Fast Scalping Forex Hedge Fund

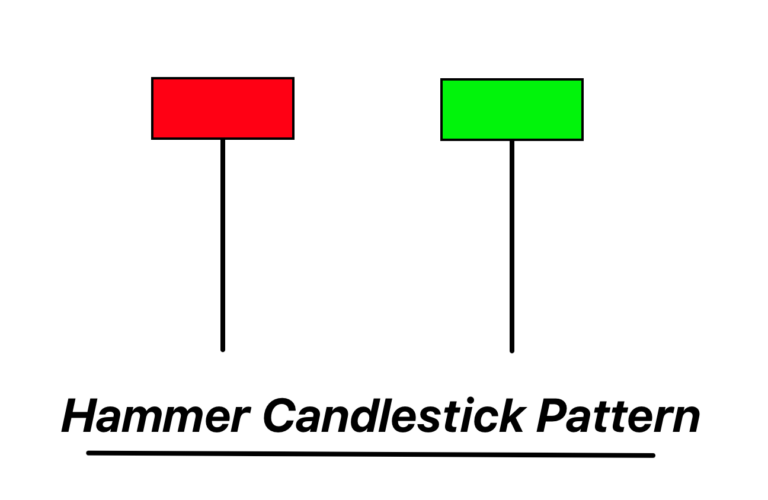

2.Hammer Candlestick Pattern (pdf) The Hammer is a singular candlestick pattern that typically forms after a downtrend. Visually, it resembles a hammer, featuring a small real body near the top of the candle and a long lower shadow. The crucial elements that define a Hammer include a small or nonexistent upper shadow, a long lower shadow, and a.

Hammer Candlestick Pattern Trading Guide in 2021 Candlestick patterns, Candlesticks, Pattern

The hammer candlestick appears at the bottom of a down trend and signals a bullish reversal. The hammer candle has a small body, little to no upper wick, and a long lower wick - resembling a.

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool By 5paisa

Bullish Candlestick Patterns Hammer. A hammer is a candlestick with a long lower wick at the bottom of a downtrend, where the lower wick is at least twice the size of the body. A hammer shows that despite high selling pressure, bulls pushed the price back up near the open. A hammer can either be red or green, but green hammers may indicate a.

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to Effective Trading Forex Bloging

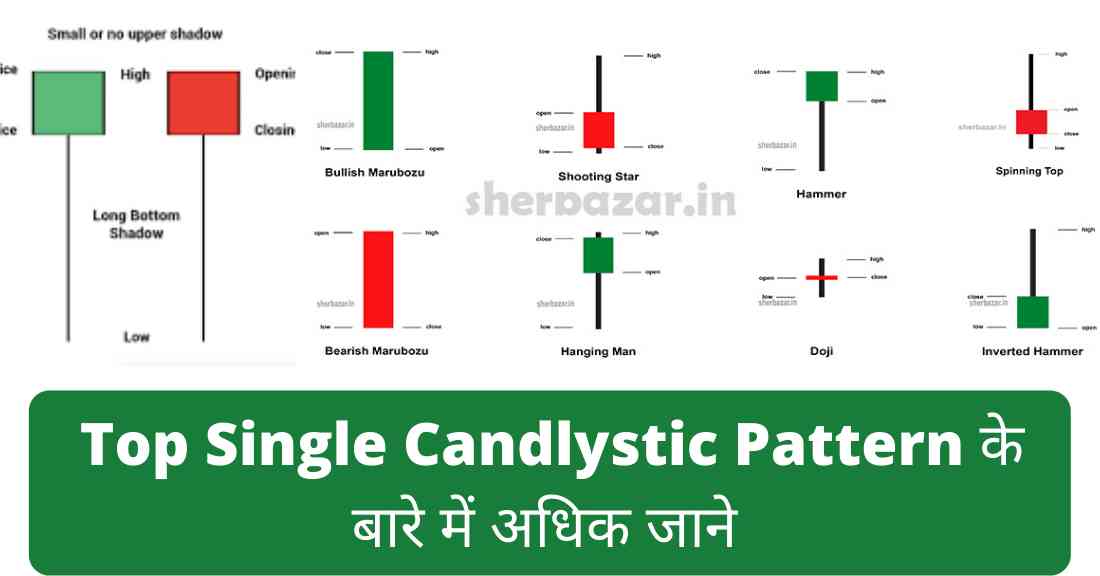

1. Hammer 2. Bullish Engulfing Bar 3. Piercing Pattern 5. Three White Soldiers 6. Three Inside Up 7. White Marubozu 8. Bullish Harami 9. Inverted Hammer 10. Tweezer Bottom 11. Three Outside Up 12. Bullish Counterattack 13. On-Neck Pattern 14. Dark Cloud Cover 15. Hanging Man

Bearish Candlestick Patterns Riset

Unlike the previous two patterns, the bullish engulfing is made up of two candlesticks. The first candle should be a short red body, engulfed by a green candle, which has a larger body. While the second candle opens lower than the previous red one, the buying pressure increases, leading to a reversal of the downtrend. 4.

This Simple Trick Could Help You Recognize the Hammer Candlestick Pattern Streak Tech

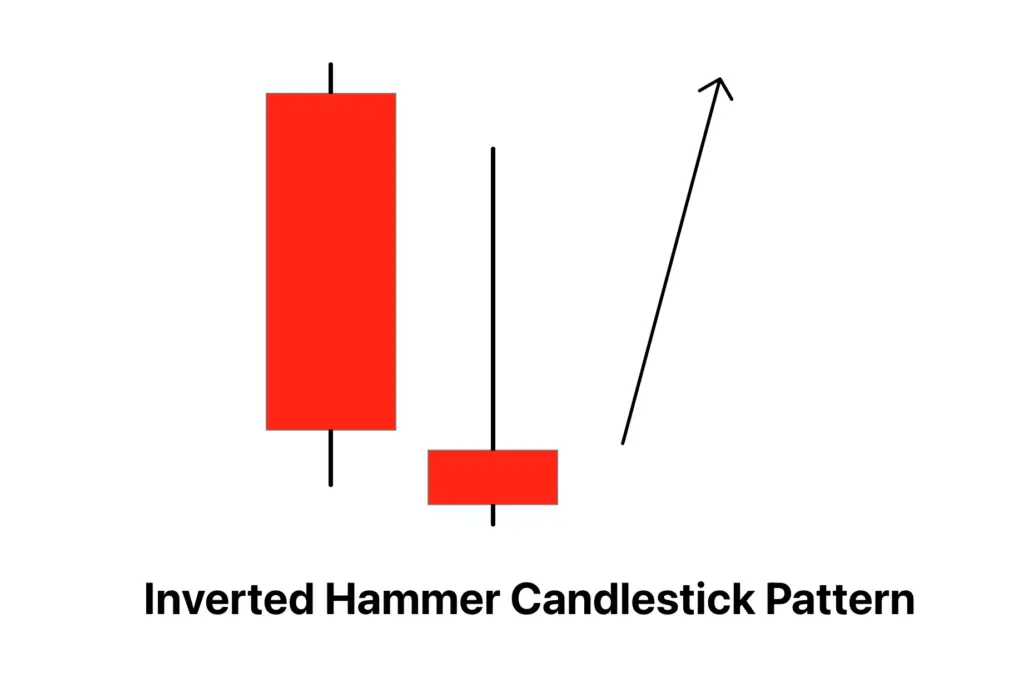

How to trade with it? What is inverted hammer candle ? How do you trade the inverted hammer candlestick pattern? DOWNLOAD FREE PDF STRATEGY VIA FINANSYA APP What is hammer Pattern? The hammer candle means a probable reversal pattern towards a bullish direction.

35 Highly effective Candlestick Chart Patterns Each Dealer Ought to Know

24 CHART PATTERNS & CANDLESTICKS ~ CHEAT SHEET 2 INTRODUCTION This is a short illustrated 10-page book. You're about to see the most powerful breakout chart patterns and candlestick formations, I've ever come across in over 2 decades. This works best on shares, indices, commodities, currencies and crypto-currencies.

What is a Hammer Candlestick Chart Pattern? NinjaTrader Blog in 2021 Candlestick chart

Inverted Hammer (bullish) & Shooting Star (bearish) This candlestick is, as you would expect - a hammer turned on its head. It is a candle with a small body and long upward wick, signally a possible reversal. Where it appears in a chart affects whether it's an inverted hammer or a shooting star. An inverted hammer forms after a downtrend or

35 Powerful Candlestick Patterns Pdf Download Riset

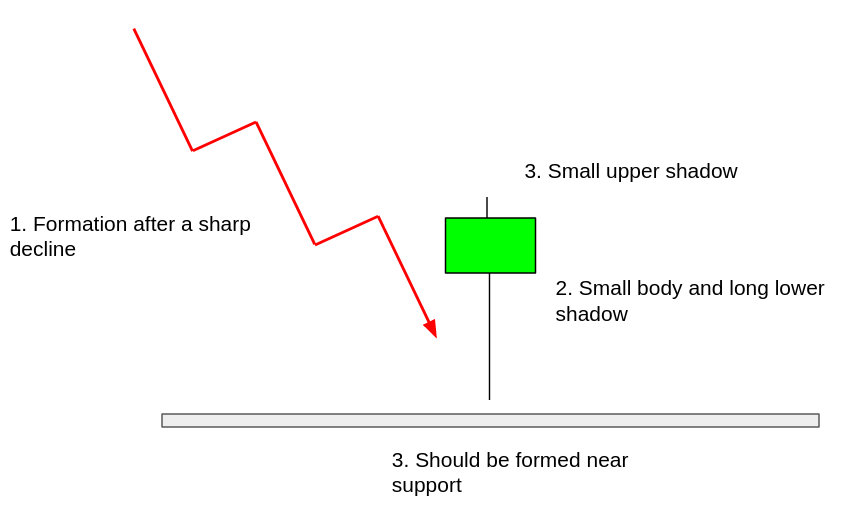

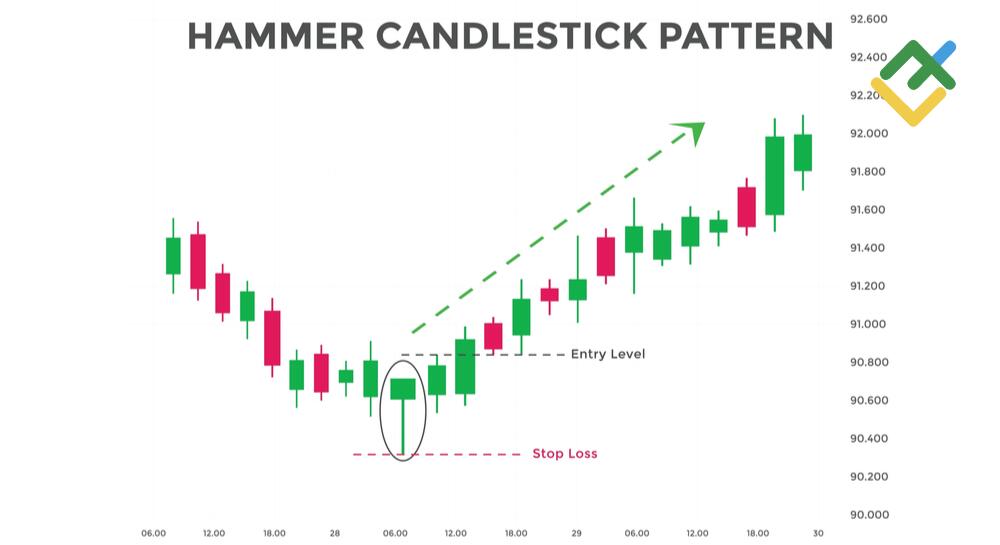

Before forming a Hammer pattern, the prior trend should be a downtrend, and there should be at least2-3 bearish candlesticks. The Hammer pattern is formed when the real body is small with a long lower shadow. To confirm the reversal, a bullish candlestick should be formed after the Hammer. Below is the daily chart of Nifty 50 in which all the.

Hammer Candlestick Pattern YouTube

dragonfly dojis are similar to hammer and hanging man patterns, which are discussed later in this guide. Hammer A "hammer" is a candlestick with a small body (a small range from open to close), a long wick protruding below the body, and little to no wick above. In this respect it is very similar to a dragonfly doji; the primary difference

Bullish Hammer Candlestick Pattern A Trend Trader's Guide ForexBee

Hanging Man Bearish single candle reversal pattern that forms in an up trend. Shooting Star Bearish single candle reversal pattern that forms in an up trend. BEARISH Bearish Engulfing Bearish two candle reversal pattern that forms in an up trend. Bearish Harami Bearish two candle reversal pattern that forms in an up trend. Dark Cloud Cover

Inverted Hammer Candlestick Pattern PDF Guide Trading PDF

Conclusion. So in this hammer trading strategy guide, you've learned: A Hammer is a (1- candle) bullish reversal pattern that forms after a decline in price. 3 things you must know about Hammer: 1) it's usually a retracement against the trend 2. It doesn't tell you the direction of the trend 3.

Hammer Candlestick Pattern with FREE PDF Download Trading PDF

The hammer puts in its appearance after prolonged downtrend. On the day of the hammer candle, there is strong selling, often beginning at the opening bell. As the day goes on, however, the market recovers and closes near the unchanged mark, or in some cased even higher. In these cases the market potentially is "hammering" out a bottom.

Bullish Hammer Candlestick Pattern A Trend Trader's Guide ForexBee

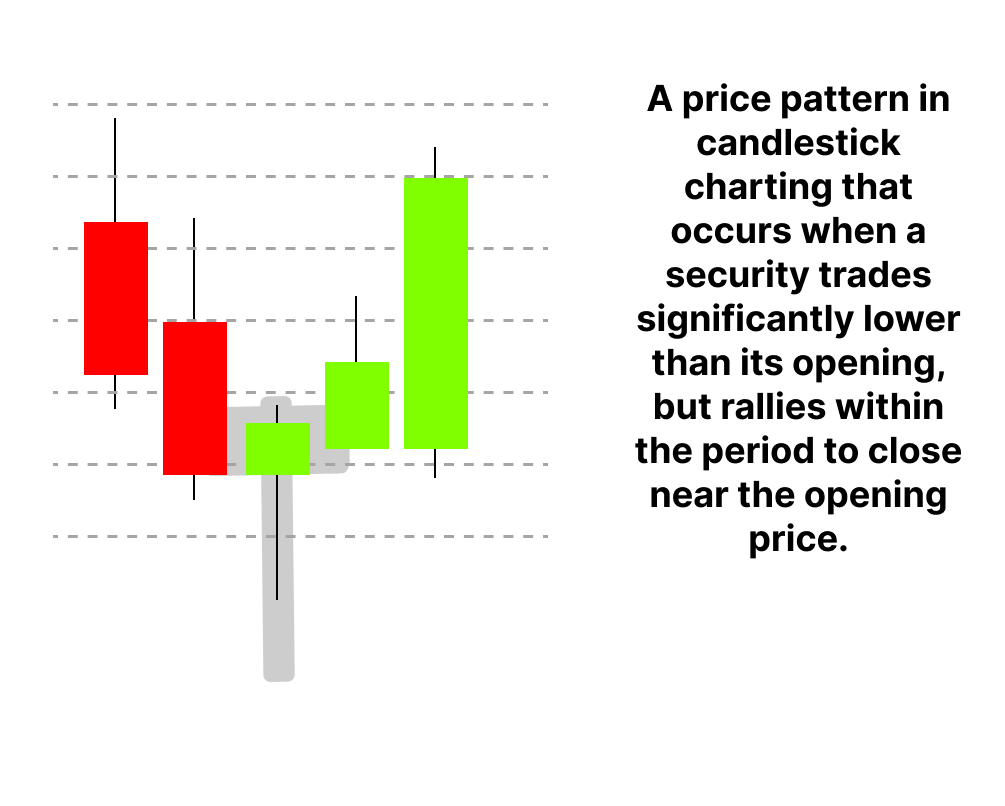

A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price..

What is and How to Trade on a Hammer Candlestick? Phemex Academy

The bullish hammer is a significant candlestick pattern that occurs at the bottom of the trend. A hammer consists of a small real body at the upper end of the trading range with a long lower shadow. The longer, the lower shadow, the more bullish the pattern. The chart below shows the presence of two hammers formed at the bottom of a downtrend.

What is a Hammer Candlestick Chart Pattern? LiteFinance

The Hammer and Hanging man are simple reversal signal of single Japanese candlesticks chart. Exhibition 1 shows how it looks like. See Full PDF Download PDF Related Papers JAPANESE CANDLESTICK CHARTING TECHNIQUES A Contemporary Guide to the Ancient Investment Techniques of the Far East James Krobot Download Free PDF View PDF