Kafalah Guarantee Law Of Obligations

Kafalah Policy Document Applicable to: 1. Licensed Islamic banks 2. Licensed takaful operators and professional retakaful operators. Imposition of fees or charges on kafalah 9 16. Recourse and recovery. 9 17. Arrangement of kafalah with other contracts or concepts 9 18. Dissolution of kafalah.

ALKAFALAH

Penjamin dapat menerima imbalan (fee) selama tidak memberatkan pihak lain. Kafalah yang menggunakan imbalan tidak bisa dibatalkan satu pihak dan bersifat mengikat. Jika ada pihak yang melanggar ketentuan, tidak melakukan kewajiban, dan terjadi perselisihan dapat diselesaikan melalui musyawarah atau Badan Arbitrasi Syari'ah.

CIMB Niaga

Kafalah Fee (Bunga) Kartu Kredit CIMB Niaga Syariah Gold "Kafalah Fee" adalah biaya atas jaminan pembayaran yang diberikan oleh Bank kepada Pemegang Kartu. "Net Kafalah Fee" adalah Kafalah Fee yang telah dikurangi dengan rebate, yang dibebankan kepada Pemegang Kartu setiap bulan melalui lembar tagihan. Kafalah Fee

Lecture 9 Kafalah PDF Guarantee Surety

Bebas Ijarah Fee (Iuran Bulanan). iuran keanggotaan (ijarah fee), Net Kafalah Fee, transaksi gesek tunai, biaya dan denda. Cashback akan diberikan kepada nasabah dengan kondisi lancar dan tidak blokir; Cashback akan dikreditkan ke Kartu Syariah Platinum Anda sebagai pengurang tagihan.

KAFALAH ALINFAQ PACKAGE AlInfaq Easing the upper and lower hands

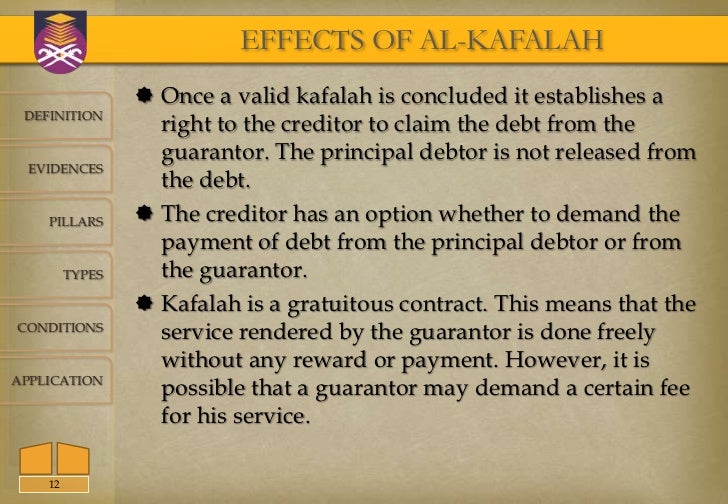

Kafalah can also be contingent or deferred to a future date where the provision of guarantee would depend on the happening of a certain incident. The contract of kafalah could generally be divided into two types: kafalah for a person (kafalah bin-nafs) and kafalah for a property (kafalahbil-mal). A creditor is prohibited to charge the debtor an.

(PDF) A Few Methods in Charging Fees for Kafālah Bank Guarantee I among Islamic Banks in Malaysia

The SAC, in its 10th special meeting dated 9 April 2009 and 95th meeting dated 28 January 2010, has resolved that: i. The application of kafalah bi al-ujr (guarantee with fee) as the appropriate Shariah concept for the guarantee facility on the sukuk issuance by Danajamin is permissible. Under this concept, Danajamin shall act as the guarantor.

Balasan dari Mengenal istilahistilah yang ada di Bank Syariah Gan Sis KASKUS

Kafalah is the guarantee for a loan and all loans must be repaid in due course according to Islamic law. The law allows the lenders to demand some sort of. In return, a sum amount of fee is charged to the customer. In the event of default by the customer, the beneficiary will claim from RHB Islamic Bank. RHB Islamic Bank makes immediate.

AlKafalah

On Bank's sole discretion, WAKALAH FEE may be waived after 3 or more years of WAKALAH period; Sole Proprietorship & Joint Account Holder can also open Kafalah Account; In case of Natural or Accidental Death Meezan Bank will also provide Additional Rupees 20,000 as Funeral Expense * 5% Wakalah fee and Takaful expense on actual rate applicable.

ALKAFALAH DAN ARRAHNU PENDIDIKAN SYARIAH ISLAMIAH TINGKATAN 4 BIDANG ALFIQH BAB 6

About Kafalah. Program Launching and Objectives. The Small and Medium En terprises Loan Guarantee Program "Kafalah " was founded under His Excellency the Minister of Finance's decision no. (1166) dated 04/05/1425 AH, with a view to overcome any obstacle in financing SMEs that are economically viable but that do not have the ability to provide.

Bantuan Kafalah Guru Ngaji Lekar BAZNAS Kota Depok

2. Based on kafalah agreement the Islamic bank issues Kafalah instrument; 3. Based on al-wakalah bi al-istithmar (investment agency) agreement the client deposits with the bank money equivalent to a certain portion of the amount of Kafalah instrument; 4. The bank charges a fee for his agency service; 5.

Mengenal Akad Fee Based Pada Bank Syariah

"Net Kafalah Fee" adalah Kafalah Fee yang telah dikurangi dengan rebate, yang dibebankan kepada Pemegang Kartu setiap bulan melalui lembar tagihan. "Pemegang Kartu" adalah pemilik Kartu yang namanya tercantum pada fisik Kartu dan sesuai dengan data-data yang tercantum pada Bank, yang sah dan berhak melakukan transaksi dengan menggunakan.

ALKAFALAH

Cash flow chart in deposit insurance contracts (kafalah bil ujr) 5.1. Shariah Issue of Charging Fees for Guarantee According to Dr. Azman Mohd Noor and Muhamad Nasir Haron, the major Shariah issue is the question of whether charging a fee (kafalah/ guarantee) is allowable.

Kafalah PDF

Kafalah bil-Maal. Merupakan jaminan pembayaran barang atau pelunasan utang. Bentuk kafalah ini merupakan medan yang paling luas bagi bank untuk memberikan jaminan kepada para nasabahnya dengan imbalan fee tertentu. Kafalah bit-Taslim. Jenis kafalah ini biasa dilakukan untuk menjamin pengembalian atas barang yang disewa, pada waktu masa sewa.

(PDF) Implementasi Kafalah dalam Lembaga Keuangan Syariah lutfi afrizal Academia.edu

Kafalah Steps. How to get a financial guarantee from Kafalah Success Stories. Our News. Latest news of Kafalah Program. View more news Success Partners Frequently Asked Questions . Help and Support Contact us.

Fée

According to BNM's Concept Paper of Kafalah, clauses 17.1 and 17.2 allows banks in Malaysia to charge a fee on Kafalah and the methods of charging fee can either be an agreed fixed amount or a percentage of the guaranteed amount. Under such requirement, the methods of charging fee vary from banks to banks according to their interpretations.

Kafalah SME Loan Guarantee Program Signs MoU with Sawahel Al Jazeera Media Co. Leaders

Asra, 2020). Maksum, (2022) states that there are differences of opinion among fiqh scholars regarding the kafalah fee at Islamic Financial Institutions because a kafalah contract is essentially a.